Playing the Ratio Game: Gold and Silver

Republished On: 5 August 2020 | 11:00 AM

Mike Ong, Senior Dealer

Mike is a member of the largest dealing team that specialises in Equities, ETFs, CFDs & Bonds and the team manages >50,000 client accounts in Phillip Securities. He evaluates stocks using fundamentals and he believes in investing long-term for passive income. He is currently the chief editor of the HQ education series that aim to equip clients with tools & skillsets to make better investing and trading decisions.

Gold price has surged to Multi-year high recently, generating massive interest in this investment amidst market uncertainties and low interest rates. This article will give you an appreciation of gold and silver, and the gold/silver ratio.

Gold

Known as the “Crisis Commodity” for its ability to retain value during financial and geopolitical uncertainties, gold has appreciated in value over the past one year. However, gold has less a popular sister known as “silver”. As prices of gold and silver tend to move in tandem, potential investment opportunities arise when silver prices differ significantly from that of gold.

Sign up for our mailing list now! Get notified with the latest articles, free webinars and more.

Silver

Apart from gold, silver is another metal that could provide protection in times of uncertainty. Here are some reasons why you can also consider Silver as investment.

- Silver can provide some inflation hedge in the long run. However, do take note that the precious metals market does not always track inflation well in the near term.

- Silver is more affordable as its price is much lower than gold.

- Silver’s metallic characteristics make it a key component in industrial uses such as solar panels. The growing concern for global warming and push for renewable energy sources could lead to an increased demand for silver.

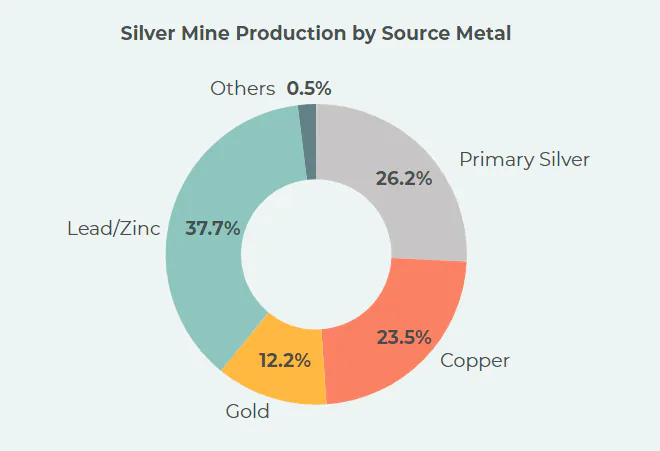

- Price of silver is affected by supply and demand. Silver is rarely found alone and more commonly found in ores that contain lead, copper, gold and other metals, which are also commercially valuable. In 2018, copper, zinc and lead form about 61% for silver mine production by source metal (see Figure 1 below from Statista). When the economy starts to slow down, the production for copper, zinc and lead also decreases, indirectly reducing the supply for silver. The difference between supply & demand can lead to price appreciation of silver.

Figure 1: Silver Mine Production by Source Metal1

- There is potentially a higher appreciation value of silver in times of economic uncertainty as compared to gold – this can be explained by the gold/silver ratio which will be discussed later.

Gold/Silver Ratio

Figure 2: Gold/Silver ratio chart for past 30 years from macrotrends

We can use the gold/silver ratio to explore possible investing or trading strategies. We can see from Figure 2 that the gold/silver ratio ranges from around 31.6 to 114.77 (as of August 2020). A high gold/silver ratio means that the value of gold is relatively expensive as compared to silver and vice versa.

Gold/Silver Ratio Investing Example

When you notice that the gold/silver ratio is higher as compared to historic averages, you can consider purchasing some silver. When the ratio is lower as compared to historic average, you might wish to get into gold instead. Using this process, you can continue to build up your inventory of gold and silver over time. This strategy may take a couple of years but is useful if you are intending to hold precious metals commodities in your portfolio. Of course, some people prefer to trade instead.

| Gold/Silver Ratio | Gold and Silver Price | Investing Signal |

| Historic high | Upward | Long Silver |

| Historic low | Upward | Long Gold |

Gold/Silver Ratio Trading Example

There are 3 steps to make use of the gold/silver ratio trend.

- Identify the trend of gold/silver ratio

- Determined the individual trend for gold and silver

- Use the table below as a guide line

| Gold/Silver Ratio | Gold and Silver Price | Trading Signal |

| Uptrend | Uptrend | Buy Gold |

| Uptrend | Downtrend | Sell Silver |

| Downtrend | Uptrend | Buy Silver |

| Downtrend | Downtrend | Sell Gold |

1. Identify the trend of gold/silver Ratio. Based on Figure 3, we can see that the gold/silver ratio forms an uptrend.

Figure 3: Gold/Silver ratio chart (Dec-18 to Jul-19)

2. Determine the individual trend for gold and silver. Based on the gold and silver chart in Figure 4 and 5 respectively, we can see that gold and silver are on an uptrend.

Figure 4: Gold chart (Dec-18 to Jul-19)

Figure 5: Silver chart (Dec-18 to Jul-19)

3. Refer to the table as a guideline. Based on the table below, the trading signal is to buy gold.

| Gold/Silver Ratio | Gold and Silver Price | Trading Signal |

| Uptrend | Uptrend | Buy Gold |

| Uptrend | Downtrend | Sell Silver |

| Downtrend | Uptrend | Buy Silver |

| Downtrend | Downtrend | Sell Gold |

Conclusion

We hope that you have a better understanding on how you can use the gold/silver ratio for trading now! When you are trading, be sure to always practice good risk management habits:

- Use of risk reward ratio to compute expected return over potential losses

- Amount of capital to risk on a trade

- Stop loss for every trade

If you’re interested in trading gold and silver, here is the list of CFDs that we offer:

If you have any questions on trading or investing, feel free to drop us an email at cfd@phillip.com.sg and we will be glad to assist you through your investment journey. There are also FREE CFD seminars that you can attend to learn more about this derivative product! Be sure to also check out our other gold articles here too!

Begin your CFD Trading Journey with us!

Sign up for our mailing list now! Get notified with the latest articles, free webinars and more.

References:

[1]https://www.statista.com/statistics/253626/global-silver-production-by-primary-source/

More Articles

Is Hong Kong Losing Its Shine?

Is Hong Kong Losing Its Shine? What is China’s grand plan for Hong Kong in the Greater Bay Area? Read more about Hong Kong’s role as an international financial hub in the heart of China.

Understanding Contracts for Difference (CFD)

“What is CFD?” might be a question that has popped up into the minds of those that just recently got acquainted with the concept of investments.

Short Selling with CFDs! Profit Your Position

If you have never attempted short-selling before, maybe it is time to start as you are losing out on 50% of the opportunities in the market. Let us take a look at some reasons to short-sell!

Disclaimer

This material is provided to you for general information only and does not constitute a recommendation, an offer or solicitation to buy or sell the investment product mentioned. It does not have any regard to your specific investment objectives, financial situation or any of your particular needs. Accordingly, no warranty whatsoever is given and not liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of your acting based on this information.

Investments are subject to investment risks. The risk of loss in leveraged trading can be substantial. You may sustain losses in excess of your initial funds and may be called upon to deposit additional margin funds at short notice. If the required funds are not provided within the prescribed time, your positions may be liquidated. The resulting deficits in your account are subject to penalty charges. The value of investments denominated in foreign currencies may diminish or increase due to changes in the rates of exchange. You should also be aware of the commissions and finance costs involved in trading leveraged products. This product may not be suitable for clients whose investment objective is preservation of capital and/or whose risk tolerance is low. Clients are advised to understand the nature and risks involved in margin trading.

You may wish to obtain advice from a qualified financial adviser, pursuant to a separate engagement, before making a commitment to purchase any of the investment products mentioned herein. In the event that you choose not to obtain advice from a qualified financial adviser, you should assess and consider whether the investment product is suitable for you before proceeding to invest and we do not offer any advice in this regard unless mandated to do so by way of a separate engagement. You are advised to read the trading account Terms & Conditions and Risk Disclosure Statement (available online at www.poems.com.sg) before trading in this product.

Any CFD offered is not approved or endorsed by the issuer or originator of the underlying securities and the issuer or originator is not privy to the CFD contract. This advertisement has not been reviewed by the Monetary Authority of Singapore (MAS).