Outlook of Yangzijiang (YZJ) Shipping Group Limited

Alvin Foo, CFD Dealer

Published On: 23 April 2019 | 05:00 PM

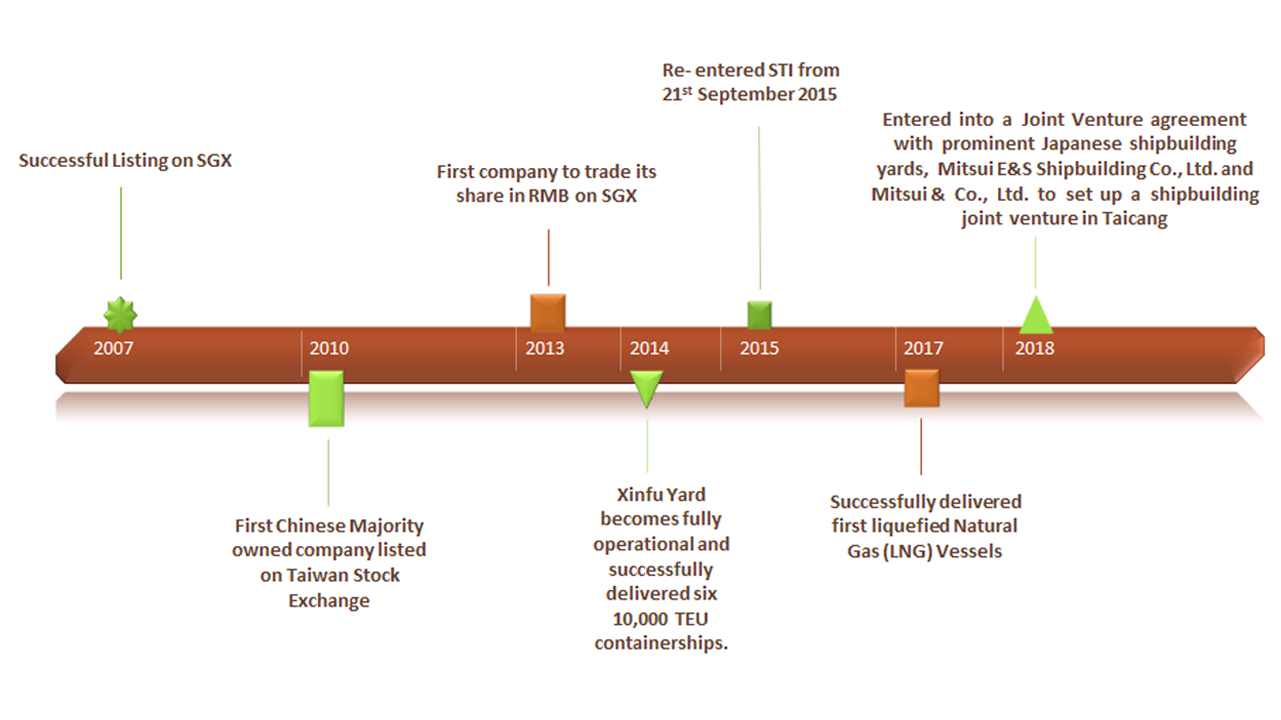

With a history stretching back as to 1956 in shipbuilding, Yangzijiang (YZJ) Shipbuilding is the first shipbuilding enterprise in China that entered the stock market in Singapore. It is listed on SGX mainboard since April 2007 and is currently one of the Straits Times Index (“STI”) constituent stocks). Since its listing in SGX, it has delivered consistent growth in the past ten years.

Timeline of YZJ Shipping Group Limited from 2007-2018

Core Business

Core Business consists of shipping and offshore Engineering

There are 4 additional sections, which include:

- Financial Investment

- Metal Trading

- Real Estate

- Shipping Combined leasing as supplementary business

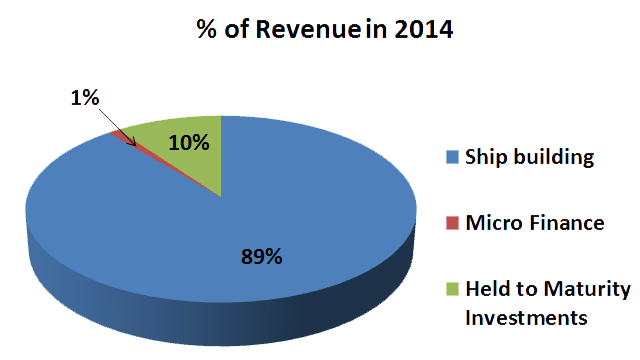

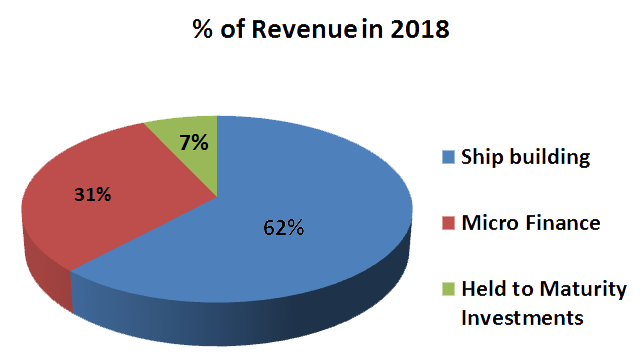

Throughout the years from 2014 to 2018, there seem to be a shift in revenue from the Group core business (Shipping) to the ownership of financial assets covering AFS Investments, financial platforms participation with opportunities arising from industry restructuring and consolidation and micro-financing. This allows the company to diversify away from its core business to help protect its capital in times of slowing demand for shipping business while continuing to provide positive returns to the shareholders of the company.

2018 was a choppy year for the STI, which lost 9.8%. From a peak of 3642 in May, it corrected 19% over six months to a low of around 2955. This is due to a series of issues and Yangzijiang was not spared from it. YZJ saw its share price plummeted from a high of $1.66 in Jan 19 to a low of $0.855 (49% decline) in 18 July 2018. It has since recovered close to 82% to $1.57 and its trading at its 52-week high.

There were mainly four key events that constitute to this decline.

- Imposition of series of tariffs from U.S to China, sparking tensions between U.S and China. (Trade War)

- China deleveraging resulting in slower-than-expected growth in economy

- Strengthening of US dollar plus rising interest rates from the FOMC, triggering a removal of funds from the emerging markets.

- Marco-economic uncertainty of the markets (iran oil sanctions, Brexit talks, weakening of currencies like Turkish lira)

Outlook

The Singapore market is still considered cheap on a historical basis with a forward PE of 12x.

Despite the uncertainties associated with global economic growth and the trade tensions between US and China, research suggests some improvement in the fundamentals in the shipping and shipbuilding market in 2019.

While global demand for container shipping is expected to remain stable and demand for seaborne dry bulk trade to grow at a faster pace in 2019, the fleet growth for both containerships and dry bulkers are expected to slow down in 2019 compared to 2018. The forthcoming IMO 2020 global sulphur cap could further limit the “active capacity” for dry bulkers due to “out of service” time for scrubber retrofits.

The recovery on the shipbuilding market was accompanied with several uncertainties. Through business cycles, YZJ has grown into a resilient entity that consistently outperformed in unstable market conditions. The market recognises our strong capabilities in the building of containerships and dry bulkers, and its order book will continue to provide a stable revenue stream in the next few years.

(Source: YZJ Press Release FY2018)

Strong order book – US $3.9B

Yangzijiang is ranked No.1 in China and No.4 in the world based on outstanding order book.

Solid balance sheet

Including Held to Maturity investments, YZJ is in net cash, equivalent to 94 cents per share or 60% of its NTA.

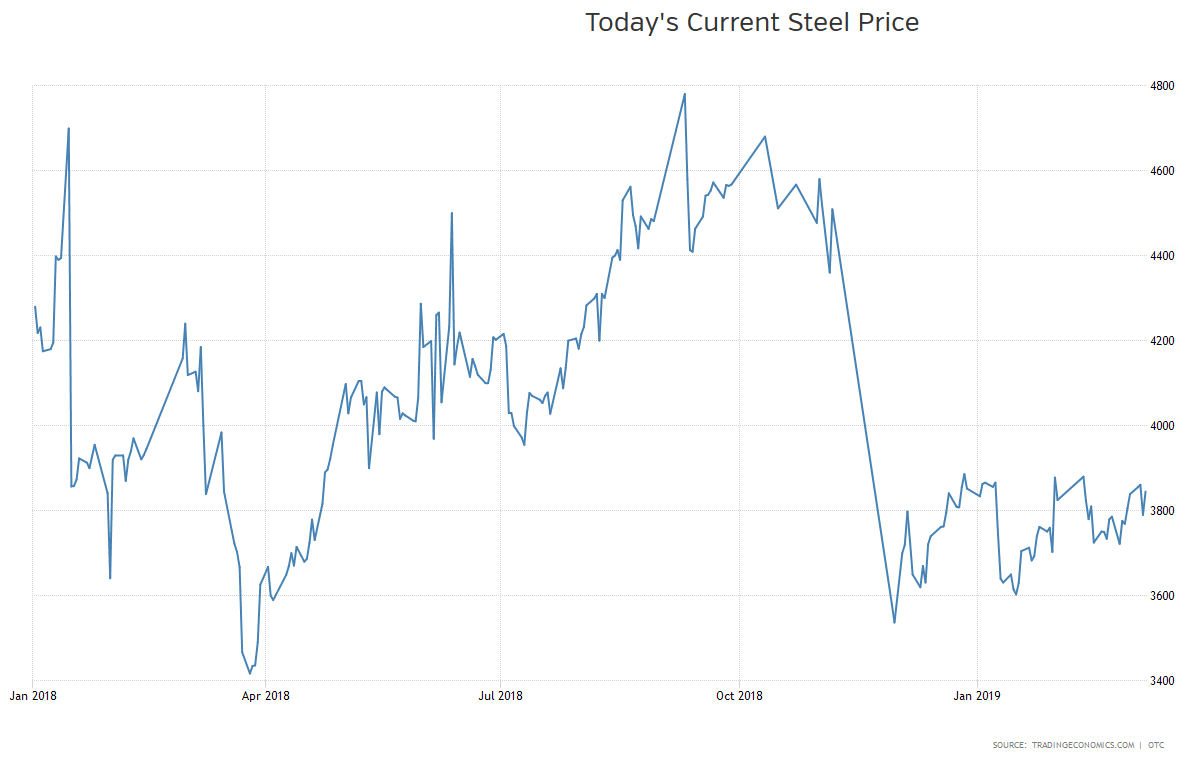

Managing Forex and Steel Price Fluctuations

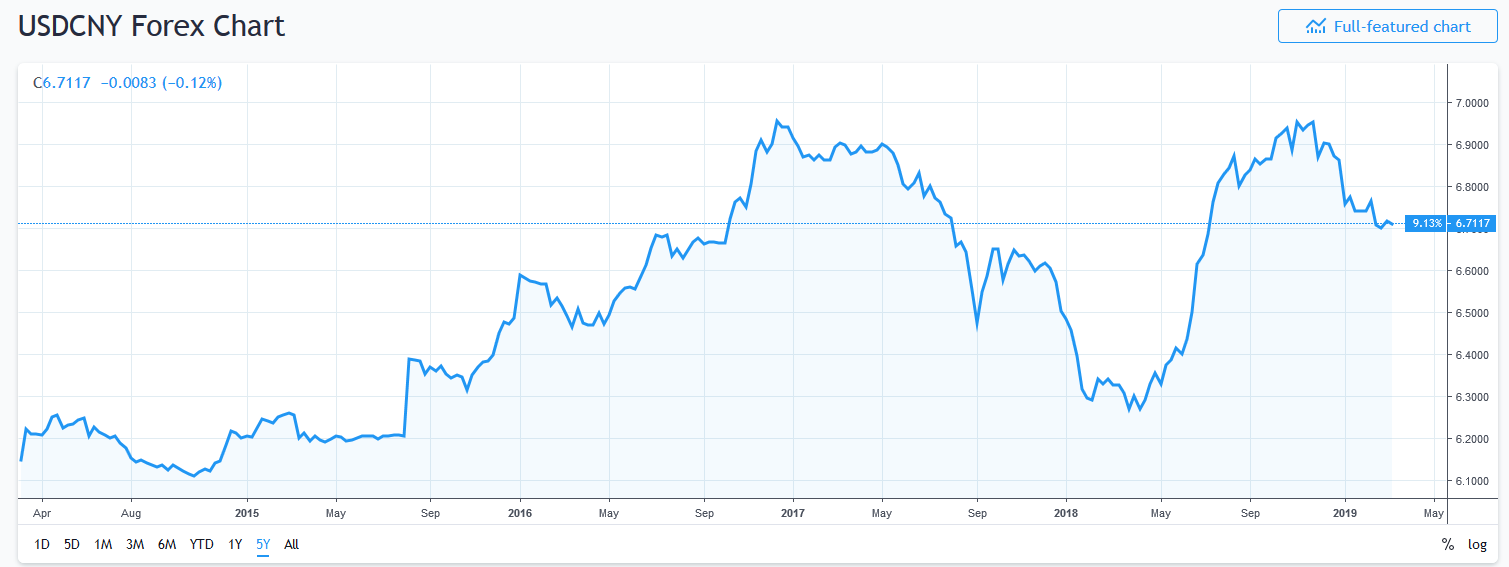

Given that most of YZJ revenue is denominated in USD while its reporting currency is Chinese Yuan (RMB), YZJ needs to stay on top of currency movement that is influenced by many Marco factors in the economy. Currency hedging can help to protect YZJ’s earnings if done correctly but a bet on the wrong side can impact its earnings. The company must also monitor the fluctuation of steel prices to ensure a ready supply of steel at a comfortable cost to ensure profitability, given that steel is a major component of its COGS.

(Source: Trading View)

Technical Analysis

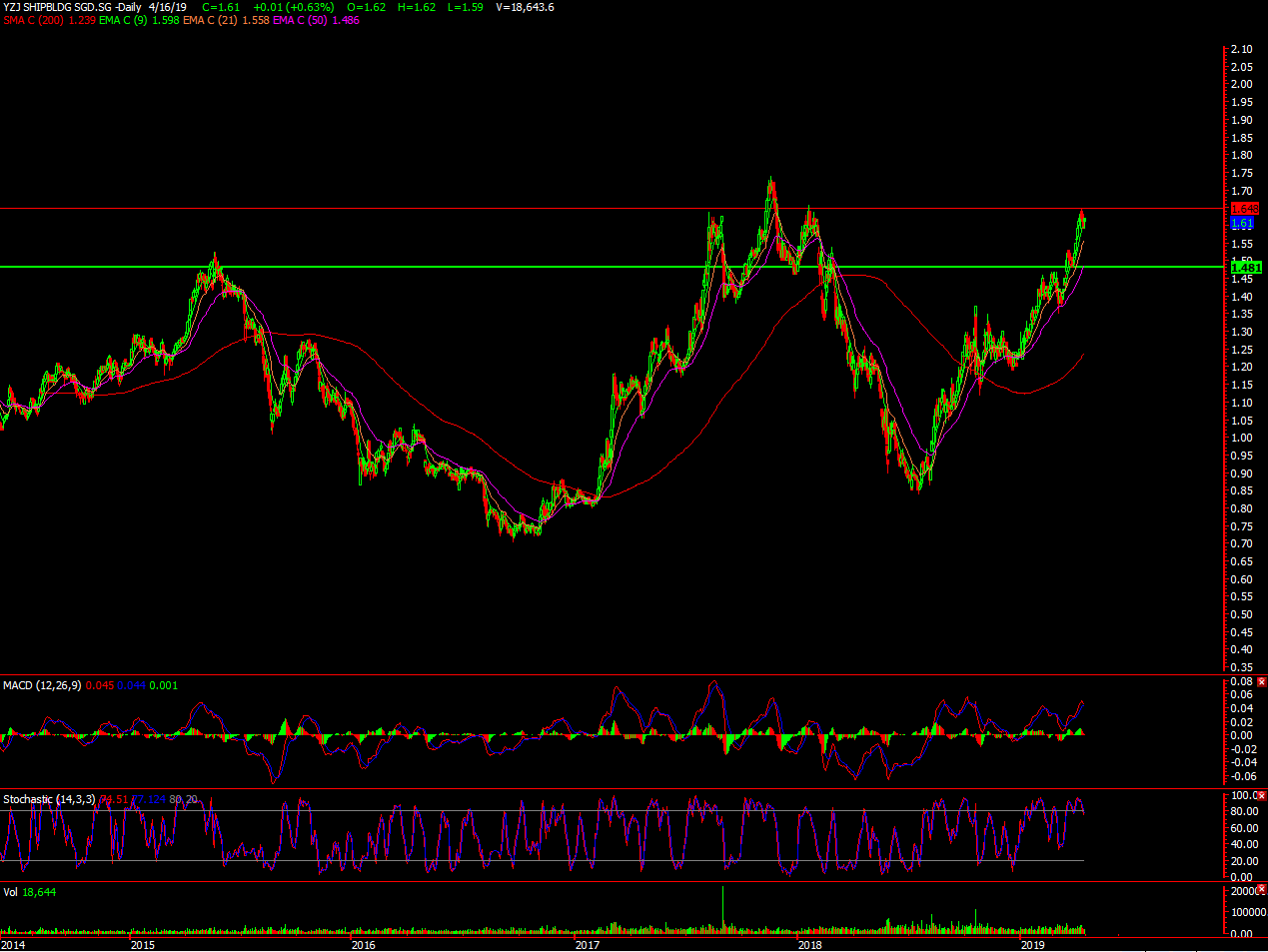

Simple Moving Average (Support and Resistance) – 17th April 2019

-Upward trending chart with above 20 & 50ma

-Heavy resistance at 1.65

-Strong support at 1.48

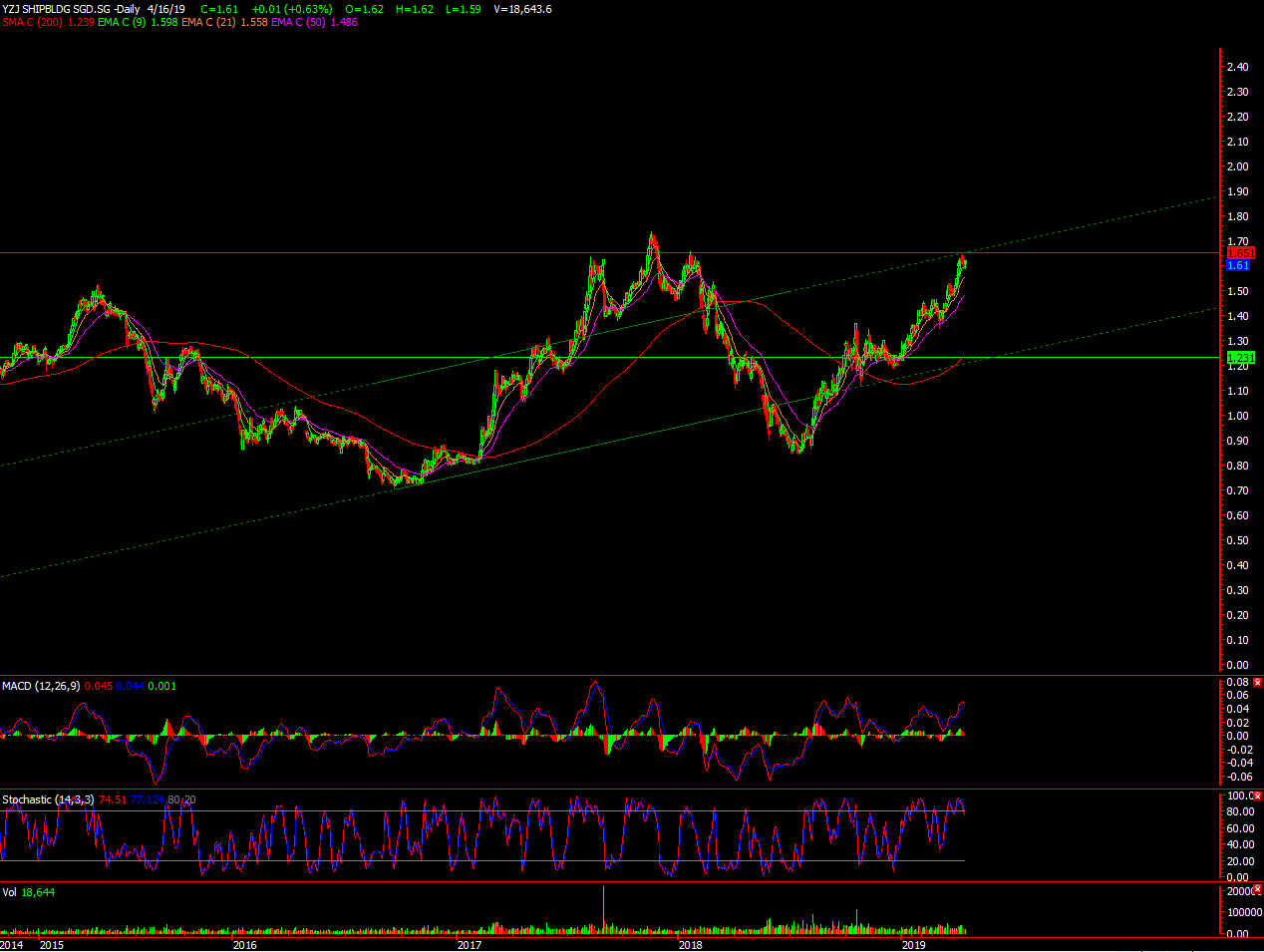

Channel – 17th April 2019

-Resistance at 1.65

-Support at 1.25

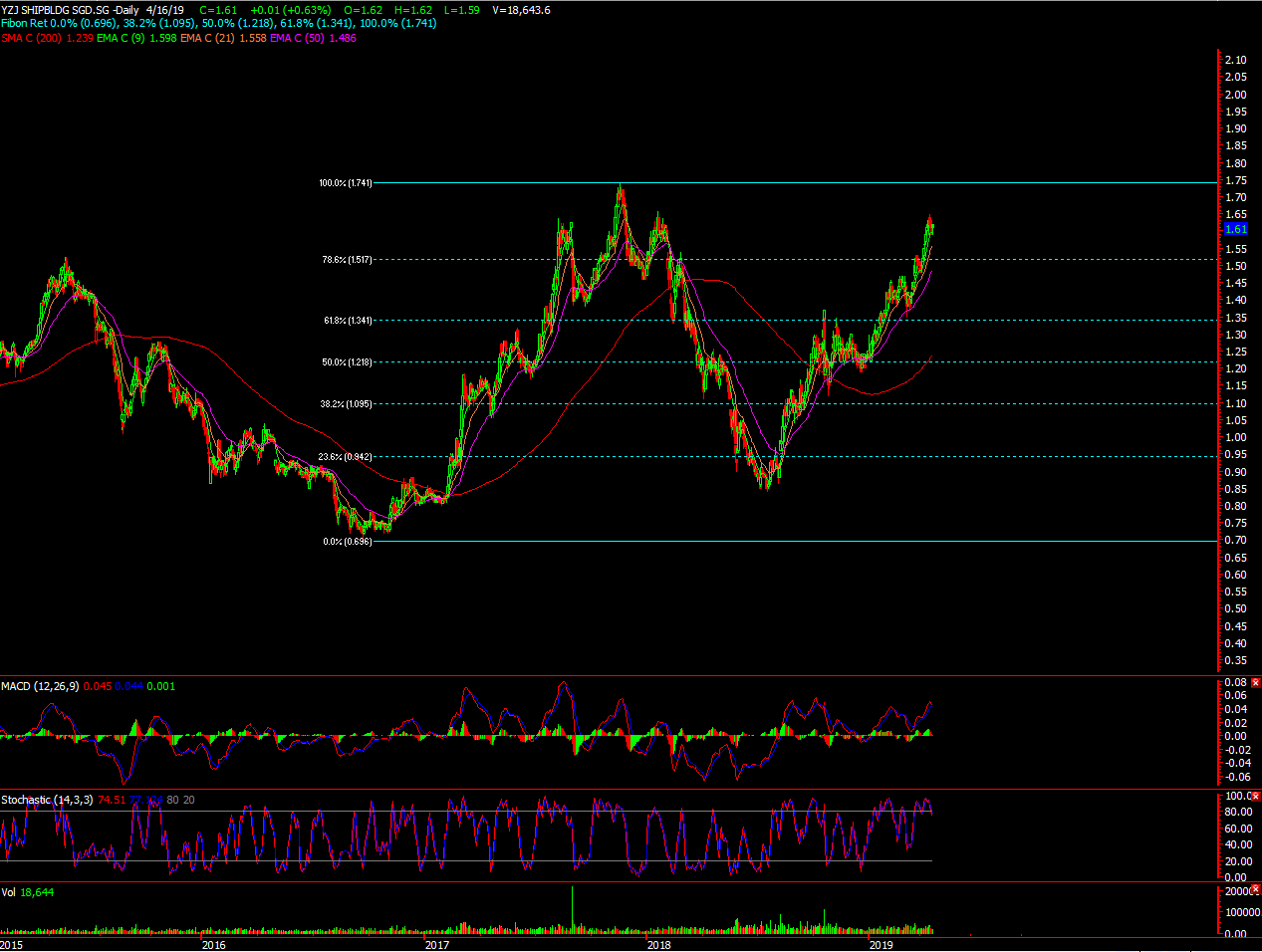

Fibonacci retracement – 17th April 2019

-31.4% to 1.52

-61.8% to 1.34

-50% to 1.22

Other Factors to look into and projects that might affect stock price

Consistent Earning Power

Companies that have a history of steady and growing earnings tend to have competitive advantages that help their businesses grow over time.

The table below shows the net profit for Yangzijiang over the past five years:

| 2018 | 2017 | 2016 | 2015 | 2014 | |

| Net Profit (RMB Million) | 3,614.04 | 2,931.50 | 1,752.40 | 2,459.60 | 3,482.90 |

Source: Bloomberg

Yangzijiang’s net profit had seen a dip from 3.48 billion in 2014 to 1.75 billion in 2016 before recovering to RMB 3.6 billion in 2018.

Good returns on equity (ROCE) while employing little or no debt

A company that has a history of generating good ROCE while employing little or no debt has a high chance of possessing durable competitive advantages.

Here’s a table illustrating Yangzijiang’s return on equity, and total-debt-to-equity ratio, from 2014 to 2018:

| 2018 | 2017 | 2016 | 2015 | 2014 | |

| ROCE | 13.20% | 12.07% | 7.88% | 11.64% | 18.20% |

| Total Debt/Equity | 0.14 | 0.18 | 0.33 | 0.37 | 0.39 |

Source: Bloomberg

The company ended 2018 with an ROCE of 13.2% and manageable debt. There is a significant improvement in the Debt/Equity Ratio over the years from 0.39 to 0.14 as of 31 December 2018.

Other projects

Oct 2018 – Joint Venture with prominent Japanese Shipbuilding entities, Mitsui E&S Shipbuilding Co., Ltd. (“MES-SC”) and Mitsui & Co., Ltd. (“Mitsui”) to expand customer base with diversified vessel types. The joint venture is expected to further enhance Yangzijiang’s shipbuilding capabilities, upgrade its product portfolio and create potential for order book growth. The joint venture will be based in the Group’s Taicang yard.

(Source: YZJ Press Release FY2018)

So what does this mean for investors?

After reading this article, you can use this opportunity to trade YZJ Shipping Group Limited Equity CFD counter or STI CFD with us, since the company is one of the constituent stocks, and Phillip CFD is the only brokerage firm that exclusively provides STI CFD in the market up till date.

What’s more, we are currently offering 40% Reduction in Spread for STI CFD until 30th June 2019.

So what are you waiting for! Trade with us now!

Leave a comment

More Articles

Understanding Contracts for Difference (CFDs)

“What is CFD?” might be a question that has popped up into the minds of those that just recently got acquainted with the concept of investments.

Beating the Efficient Market Hypothesis

If you have any sort of finance background, you will probably have heard of the Efficient Market Hypothesis (EMH). It’s an economic theory that states that all available information are reflected in the prices..

Top 10 common trading mistakes [with solutions!]

Stay tuned as we list out the Top 10 trading mistakes which we observed from our clients. Why this is so important? Because such events will happen again and Will YOU be able to benefit from it?

Disclaimer

This material is provided to you for general information only and does not constitute a recommendation, an offer or solicitation to buy or sell the investment product mentioned. It does not have any regard to your specific investment objectives, financial situation or any of your particular needs. Accordingly, no warranty whatsoever is given and not liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of your acting based on this information.

Investments are subject to investment risks. The risk of loss in leveraged trading can be substantial. You may sustain losses in excess of your initial funds and may be called upon to deposit additional margin funds at short notice. If the required funds are not provided within the prescribed time, your positions may be liquidated. The resulting deficits in your account are subject to penalty charges. The value of investments denominated in foreign currencies may diminish or increase due to changes in the rates of exchange. You should also be aware of the commissions and finance costs involved in trading leveraged products. This product may not be suitable for clients whose investment objective is preservation of capital and/or whose risk tolerance is low. Clients are advised to understand the nature and risks involved in margin trading.

You may wish to obtain advice from a qualified financial adviser, pursuant to a separate engagement, before making a commitment to purchase any of the investment products mentioned herein. In the event that you choose not to obtain advice from a qualifies financial adviser, you should assess and consider whether the investment product is suitable for you before proceeding to invest and we do not offer any advice in this regard unless mandated to do so by way of a separate engagement. You are advised to read the trading account Terms & Conditions and Risk Disclosure Statement (available online at www.poems.com.sg) before trading in this product.

Any CFD offered is not approved or endorsed by the issuer or originator of the underlying securities and the issuer or originator is not privy to the CFD contract. This advertisement has not been reviewed by the Monetary Authority of Singapore.