Navigating Hong Kong Indexes- Insights, Challenges, and Opportunities

Hei Tung Sam, Assistant Manager, Dealing

Sam graduated from National University of Singapore with a Master of Science in Finance. He personally manages his own investment portfolio and does equity and economic research in his free time. Sam believes that education and information is essential to making good financial decisions.

This article aims to equip you with a broad range of useful information on Hong Kong indices, the recent headwinds, potential upturns and how you can gain exposure & take action now.

A financial index provides a numerical score that tracks the performance of a group of assets that forms the index [1]. Indices can be broad based, such as the S&P 500 which represents the entire US stock market, or focused on particular sectors like the Hang Seng Tech Index which targets the technology sector or the Russell 2000, which focuses more on the smaller-cap US stocks.

Currently, there are three major Hong Kong indices:

- Hang Seng Index (HSI): 82 components.

- Hang Seng China Enterprises Index (HSCEI): 50 components.

- Hang Seng Tech Index (HSTECH): 30 components.

The Hang Seng Index (HSI) was launched on 24 November 1969 by Hang Seng Bank to track the top performing stocks on the Hong Kong Exchange [2]. Initially consisting of 33 constituents, the HSI primarily focused on blue-chip stocks, serving as a reliable measure of Hong Kong’s overall stock market performance [3].

The Hang Seng Index has weathered numerous crises, from Black Monday to the handover of Hong Kong from British rule to China in 1997, and Asian financial crisis. During the Asian financial crisis, hedge funds led by George Soros launched waves of speculative attacks on the Hong Kong Dollar’s peg to the US Dollar and on Hong Kong equities. In response, the Hong Kong Monetary Authority (HKMA) and the Hong Kong government with the backing of Beijing defended the Hong Kong Dollar and Hong Kong equity markets by purchasing HK$118 billion worth of stocks and futures [4]. This decisive intervention drove away international speculators and restored confidence in both the Hong Kong Dollar peg and the Hong Kong equity market.

Market participants trade and invest in Hong Kong indices mainly to gain exposure to the second largest market in the world, China and its long-standing trajectory of economic growth. Over the past 30 years, China has demonstrated an exceptional growth rate, coupled with a focus on improving quality of life and infrastructure [5]. Furthermore, the Hong Kong Dollar’s peg to the US Dollar reduces currency risk for overseas investors, offering greater accessibility and attracting more funds as compared to other Asian markets with floating exchange rates.

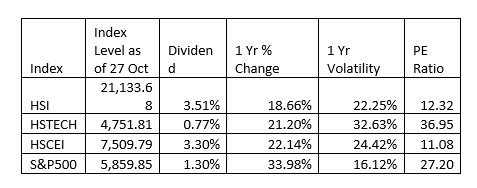

A comparison of the three major Hong Kong indices with the S&P 500 reveals significant differences. Both the HSI and HSCEI have a lower Price-to-Earnings (P/E) ratio of 11-12, compared to S&P 500’s P/E ratio of 27. Volatility is way higher among the Hong Kong Indices, and the 1 Yr % change is lagging behind the S&P 500. However, the dividend yield for HSI and HSCEI is ~3.30%, compared to just1.30% for the S&P 500.

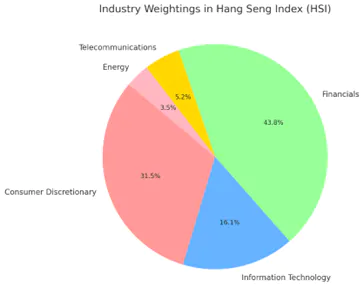

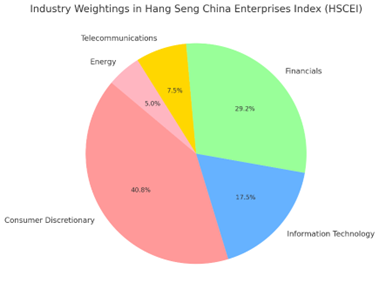

The large industry weightings in the financial & telecommunication sector mainly drives the higher dividends for both HSI and HSCEI. Key contributors include heavy weighted financial companies like China Mobile, Bank of China, China Construction Bank, ICBC, Ping An Insurance, contributing a large weightage for both HSI and HSCEI. These companies benefit from strong and predictable cash flows and operate in mature industries, enabling them to maintain high dividend payouts. On the other hand, Hong Kong Indices tend to have higher volatility due to macro news coming out of China, which swings the market violently creating pockets of opportunity for traders to take advantage.

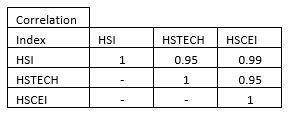

All three major Hong Kong indices are highly correlated with each other as seen in the table below.

Understanding Correlation

Correlation in finance refers to the degree to which two financial instruments move in relation to each other [6]. Correlation ranges from negative correlation (-1) to zero correlation (0) and positive correlation (1). With a correlation of 0.95 and above between the HSI, HSTECH and HSCEI means that the indices tend to move in the same direction with and by similar magnitudes.

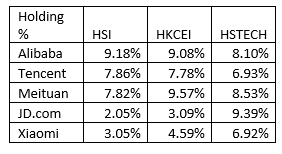

The Top 5 China/Hong Kong stocks are shown in the table below:

These Top 5 stocks contribute a significant proportion to all three Hong Kong indices, and often influence market movements during earnings season. Market participants should keep a close watch on these stocks. During the tech stock crackdown in 2020, the Chinese government was targeting top tech companies such as Alibaba and Tencent for monopolistic practices and Alibaba was fined US$2.8billion in an antitrust case [7], sending shockwaves across China’s internet industry. This intervention heightened investor concerns over further regulatory crackdowns and government interventions in the tech sector.

Currently, China and Hong Kong are experiencing a slowdown in economic growth, with projected GDP growth for 2024 at 4.8%, significantly lower than the golden years and missing its 5% target [8]. Additionally, China’s property market continues to struggle, exacerbated by the liquidation of Evergrande Group, which has placed immense financial stress on Chinese property developers and led to stagnant or declining home prices. This situation has caused domestic consumers to become pessimistic as roughly 70% of household wealth is in property [9]. A slow but damaging deflation wave has caused consumers to delay spending further driving down demand and unemployment. High youth unemployment has plagued the job market causing systemic damages to the upcoming generation.

In September 2024, the People’s Bank of China (PBOC) released an economic stimulus package that aims to address China’s economic slowdown, property market and financial markets [10]. Measures included cutting overall interest rates, reducing banks’ reserve requirements, and providing targeted support to the property sector. Furthermore, Shanghai has unveiled a 500-million-yuan voucher plan to boost consumption in the same month. This shows that the Chinese government and PBOC is focusing on ways to bolster the economy and domestic consumption. Analysts and market participants are weighing in on the effectiveness of the stimulus package while more detailed information is being released.

Conclusion

Hong Kong Indices offer an excellent opportunity for both investors and traders to gain exposure to the Chinese economy. The different indices encompass a broad range of components, are highly correlated, and are primarily driven by the top five companies. Despite current financial turbulence and economic headwinds, the recent shift in policy direction aimed at addressing these challenges offers a glimmer of hope. With effective interventions from the PBOC and the Chinese government, the next bull market could be on the horizon.

Trade Hong Kong Indices with POEMS Index CFDs

Traders and investors can gain exposure to the Hong Kong Indices through POEMS Index CFDs. Where you can go both long or short, gain access to extended trading hours and trade up to 20x leverage. Currently Phillip CFD offers all 3 major Hong Kong index with Hong Kong Index (HSI), Hong Kong Tech Index (HSTECH) and H-Shares Index (HSCEI). The Hong Kong Index CFDs are cash-correlating and may not be at the same index value point as the underlying cash index but are certainly well correlated to them. You should also take note that index CFDs are traded on margin, which can amplify both your gains and losses. Hence, you are advised to adopt proper risk management measures before engaging in margin trading as there is a potential that losses will be greater than your initial capital.

The hedging strategy involves fully hedging between March and September, assuming poor stock market performance during this period. The speculative strategy, however, takes a short position on the stock market index between March to September, aiming to capture potential profits from the anticipated market downturn. The experiment is conducted on the STI and KLCI indices respectively.

Portfolio B (Hedging) – Profit is realised at the end of every February. Positive returns from October to February outweigh the negative returns, resulting in overall growth

Portfolio C (Speculative) – Profit is realised at the end of every February and October. Shorting the index from March to October increases the returns of the portfolio by capitalising on market declines. The effect of the stock market crash in 2008 is also slightly mitigated as there was some profits gained from the short positions.

Portfolio D (Buy-and-Hold) – Profit is only realised at the end of the data. The index trends higher at the end of the data period but the portfolio experiences an increasing high equity drawdown post-2018.

Portfolio E (Hedging) – Profit is realised at the end of each February. Similar to Portfolio B, positive returns from October to February have a stronger effect than the negative returns, leading to overall growth.

Portfolio F (Speculative) – Profit is realised at the end of February and October. Shorting from March to October significantly boosts returns by leveraging the index’s decline. From 1996 to 2004, the market followed the statement closely, resulting in substantial realised profits.

How to get started with POEMS

POEMS’ award-winning suite of trading platforms offers investors and traders more than 40,000 financial products across global exchanges.

Trade Smarter and Faster

With our newly launched POEMS Mobile 3 Trading App

Explore a myriad of useful features including TradingView chartings to conduct technical analysis with over 100 technical indicators available!

Take this opportunity to expand your trading portfolio with our wide range of products including Stocks, CFDs, ETFs, Unit Trusts and more across 15 global exchanges available for you anytime and anywhere to elevate you as a better trader using our POEMS Mobile 3 App!

For enquiries, please email us at cfd@phillip.com.sg.

References

[1] https://www.investopedia.com/terms/i/index.asp

[2] https://www.hsi.com.hk/eng/indexes/all-indexes/hsi

[3] https://www.moneycontrol.com/live-index/hangseng?symbol=cn;hsi#goog_rewarded

[6] https://corporatefinanceinstitute.com/resources/data-science/correlation/

[7] https://www.nytimes.com/2021/04/09/technology/china-alibaba-monopoly-fine.html

[8] https://www.reuters.com/world/china/chinas-economy-set-grow-48-2024-missing-target-2024-10-15/

More Articles

Playing Defence: Diversification in Forex Trading

Learn how strategic planning and risk management can help you navigate the highs and lows of the forex market. Don’t miss out on unlocking the secrets to long-term profitability!

From Boom to Bust: Lessons from the Barings Bank Collapse

Did you know that the collapse of Barings Bank in 1995 was from massive losses incurred by a rogue trader? Delve into the tale of how Nick Leeson’s fraudulent investments sent shockwaves through the financial world.

Japan's Economic Resurgence – Unveiling the Tailwinds Behind Nikkei 225’s Record Leap

Discover the driving forces behind Japan’s market surge, delve into its economic performance and learn how CFD products can help you navigate the Japanese market’s volatility via our article!

Disclaimer

These commentaries are intended for general circulation and do not have regard to the specific investment objectives, financial situation and particular needs of any person. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. You should seek advice from a financial adviser regarding the suitability of any investment product(s) mentioned herein, taking into account your specific investment objectives, financial situation or particular needs, before making a commitment to invest in such products.

Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of units in any fund and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance.

Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

CFD Promotion Disclaimer

This promotion is provided to you for general information only and does not constitute a recommendation, an offer or solicitation to buy or sell the investment product mentioned. It does not have any regard to your specific investment objectives, financial situation or any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of your acting based on this information.

Investments are subject to investment risks. The risk of loss in leveraged trading can be substantial. You may sustain losses in excess of your initial funds and may be called upon to deposit additional margin funds at short notice. If the required funds are not provided within the prescribed time, your positions may be liquidated. The resulting deficits in your account are subject to penalty charges. The value of investments denominated in foreign currencies may diminish or increase due to changes in the rates of exchange. You should also be aware of the commissions and finance costs involved in trading leveraged products. This product may not be suitable for clients whose investment objective is preservation of capital and/or whose risk tolerance is low. Clients are advised to understand the nature and risks involved in margin trading.

You may wish to obtain advice from a qualified financial adviser, pursuant to a separate engagement, before making a commitment to purchase any of the investment products mentioned herein. In the event that you choose not to obtain advice from a qualified financial adviser, you should assess and consider whether the investment product is suitable for you before proceeding to invest and we do not offer any advice in this regard unless mandated to do so by way of a separate engagement. You are advised to read the trading account Terms & Conditions and Risk Disclosure Statement (available online at https://www.poems.com.sg/) before trading in this product.