A Modern Guide To Mastering The Forex Market

Onisha Thye, Dealer

Onisha is a dealer at the CFD Dealing Desk. She graduated from Monash University with a double major in finance and econometrics. Her natural curiosity for finance is what drove her to be in this field as she is fascinated by all the possibilities and opportunities that are available to grow one’s wealth, either through trading or investment.

The world of foreign exchange (FX) has evolved significantly over the years. Technological advancements and an ever-growing global economy has improved the accessibility, speed and efficiency of the FX market, shaping it into the largest financial market in the world. Whether you are a beginner or an experienced trader looking to dip your toes into the world of FX, this article will help you understand its core principles and modern strategies in today’s landscape

Basics of Forex Trading

FX trading involves the exchange of one currency for another and is typically traded in currency pairs such as USD/JPY or EUR/USD. The FX market operates 24 hours a day, 5 days a week and is decentralised, which means that transactions occur over-the-counter (OTC) rather than on a centralised exchange.

Unlike stock markets, FX trades happen directly between two parties without centralised exchange. A buyer and a seller agree to exchange one currency for another at an agreed rate. The parties may include financial institutions, corporations, banks or individual traders. Both parties will negotiate an exchange rate which is influenced by factors like interest rates, economic conditions and market demand for those currencies.

Some examples of S-REITs include Mapletree Pan Asia Commercial Trust (which owns Vivo City) and CapitaLand Integrated Commercial Trust (which has a stake in ).

Key terms in FX Trading

- Currency Pairs

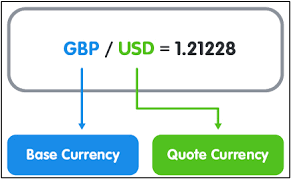

A currency pair consists of a base currency and a quote currency.

(1)

The GBP/USD currency pair above shows that GBP is the base currency while USD is the quote currency. If the rate is 1.21228, it means that 1 GBP can be exchanged for $1.21228 USD. If this rate rises to 1.3, it indicates that GBP has strengthened against USD.

2. Bid and Ask Prices

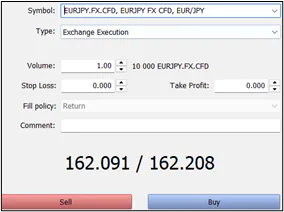

(2) Example from the POEMS CFD MT5 platform

The price $162.091 represents the bid price, which is the price buyers are willing to pay. The price $162.208 represents the ask price, which is the price sellers are asking for.

The difference between the bid and ask prices is called the spread. In this case, the spread is equal to 0.117.

3. Pips

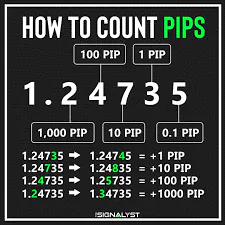

(3)

A pip (Percentage in Point or Price Interest Point) is the smallest price movement in a currency pair, often representing a 0.0001 change in value or one one-hundredth of a percent. For example, EUR/USD currency pair moves from 1.2473 to 1.2474, it has moved by 1 pip. When price change in pips may seem small, its cumulative effect can have a significant impact on your trading results, especially when using leverage. We will dive into leverage later on in this article.

Pips in Major currency pairs vs Japanese Yen

Most currency pairs are priced to 4 decimal places, where one pip equals 0.0001. However, for currency pairs involving the Japanese Yen (JPY), one pip equals to 0.01 as the Yen is traditionally quoted to 2 decimal places. The example below illustrates how this difference affects Profit and Loss (P&L) calculations when trading JPY pairs.

| Currency pair | From | To | Pip |

| EUR/USD | 1.1003 | 1.1004 | 1 |

| USD/JPY | 110.01 | 110.02 | 1 |

4. Lot sizes in FX

Lot sizes in FX trading measure the amount of the underlying asset being traded. These are divided into standard lots and mini lots, each offering different levels of exposure to the FX market.

1 Standard lot: 100,000 units of the base currency

*Used by experienced traders with larger capital, allowing them to control a higher volume

1 Mini lot: 10,000 units of the base currency

*Ideally for investors who want to control a smaller position with less capital at risk which makes it more accessible to retail traders. It is also used by beginner traders to practice trading strategies with minimal financial risk.

Why Trade FX?

Let’s take a quick dive into why traders should trade in the FX market. It offers several advantages:

a. High liquidity

The FX market has daily trading volume exceeding US$6 trillion, making it the most liquid financial market globally. (4)

b. Leverage

Traders can control large positions with relatively small capital due to leverage, amplifying potential gains (as well as risks).

c. Accessibility

FX trading platforms are widely available, enabling traders to start with minimal capital.

d. Flexibility

The FX market is open 24 hours a day, 5 days a week, allowing you to participate at your convenience.

e. Short-selling

You can take advantage of falling prices (depreciating currency pairs) by initiating short positions.

Source: Singapore Department of Statistics (DOS)

Modern Strategies for FX Trading

We are seeing an exciting evolution of how traders approach FX trading, especially with the rise of the 3 modern strategies, particularly Algo Trading, Social Trading and Hedging Strategies. These strategies leverage technology and innovation to offer traders enhanced ways to make informed decisions, minimise risks and maximise profits. Whether you are a beginner or a seasoned trader, these strategies offer fresh perspectives on the market, reducing uncertainty and adding confidence to your trading journey.

1. Algorithmic Trading (Algo Trading)

Algo Trading uses computer algorithms to execute trading decisions automatically based on predefined criteria. It is like giving your computer a set of instructions to handle your trades. Instead of monitoring the market 24/7 and reacting to price movements, the algorithm analyses market data, identifies trends, and executes trades faster and more efficiently than a human trader.

If you intend to engage in Algo Trading, it is crucial to develop coding proficiency or collaborate with a skilled programmer who can develop it for you based on your requirements. Coding proficiency allows traders to customise their trading algorithms, execution speed and adapt to market conditions. With an Algo Trading script, it is essential for you to back test

your strategy before deploying it into live markets. This process involves running historical market data through your algorithm to evaluate its performance. Proper back testing helps to minimise risks and improve the likelihood of a successful trading strategy.

2. Social Trading: Learning and Growing Together

Your trading journey doesn’t have to be a solitary endeavour. Social trading allows one to tap into a community of traders sharing insights, strategies and successes. Imagine being able to observe how top traders make decisions and even replicate their trades automatically. It is like being able to learn from the best while participating in a community that is there to support you.

3. Hedging: Protecting Your Investments

In trading, the market sometimes moves in ways we cannot predict. But what if you could protect yourself from those unexpected changes? That is where hedging comes in. Hedging involves mitigating potential losses in a position by taking an opposite position in the same or correlated asset. This helps you to minimise risk and offers you a safety net in volatile times.

For example, a trader who is long EUR/USD and is concerned that a higher US non-farm payroll (NFP) report indicating a strong jobs market could lead to the strengthening of the USD and negatively impacting his position, could hedge against this risk by establishing a short position on EUR/USD ahead of the NFP announcement.

Similarly, a trader who is short EUR/USD can establish a long position on a EUR/USD as a hedge, if he is anticipating a weaker NFP report which could lead to the depreciation of the USD. The trader having hedged against such potential market reactions would have largely mitigated the extent of any losses resulting from any adverse movements.

4. Hedging for Businesses

Companies around the world have increasingly turned to FX hedging to hedge against potential currency volatility driven by political uncertainties including the presidential election in 2024 and divergent central bank interest rate policies. A survey by MillTechFX revealed that 90% of US businesses plan to increase their proportion of currency hedging from 46% in Q1 2024 to 48% in Q2 2024 (5). This trend highlights the growing importance of hedging strategies in managing risks associated with political events and monetary policy shifts.

Using Contract for Difference (CFD) to gain exposure to FX

A CFD is a financial agreement between two parties to exchange the difference in the value of a financial asset between the time the contract is opened and closed. CFDs are derivative products available across a wide range of financial assets such as FX, stocks, indices and commodities. When trading CFDs on FX, you participate in the price movements of the FX currency pairs without owning physical currencies.

At Phillip CFD, we offer access to the award-winning Meta Trader 5 (MT5) platform for trading FX CFDs. MT5 provides a comprehensive suite of features, including advanced charting tools, a wide range of technical indicators, and the ability to automate trading strategies through Expert Advisors (EAs), subscribe to trading signals and the ability to have multiple positions per counter, including oppositely directed ones, empowering you to apply a wide range of strategies.

Conclusion

FX trading offers many opportunities for those who are looking to speculate, hedge or invest in currency price movement. With access to the global currency market, FX trading allows you to trade both rising and falling markets with the flexibility of leverage. It is easy to see why many traders are attracted to this financial instrument. However, these advantages come with risks as well particularly around leverage and market volatility. It is essential to educate yourself and undertake appropriate risk management to be better equipped in navigating the world of FX trading and achieve your financial goal.

How to get started with POEMS

POEMS award-winning trading platforms now bring you MetaTrader 5 (MT5), offering traders a world-class experience with advanced tools and seamless access to CFDs on forex, indices, commodities, and more.

Experience superior trading tools with over 80 technical indicators, customisable charts, and algorithmic trading options. Whether you’re a beginner or an experienced trader, MT5 empowers you with the tools needed to seize trading opportunities.

Open Your POEMS CFD MT5 Account Today

To start trading on POEMS CFD MT5, you’ll need an existing POEMS account. If you don’t have one yet, sign up for a POEMS account now to unlock the gateway to seamless CFD trading on MT5.

Take advantage of the flexibility to trade CFDs on global markets with leverage, enabling you to diversify your portfolio and maximise trading potential anytime and anywhere.

For enquiries, please email us at cfd@phillip.com.sg

References

References

(1) https://www.babypips.com/learn/forex/make-money-trading-forex

(2) POEMS CFD MT5 platform

(3) https://www.pinterest.com/pin/how-to-count-pips–886153664160629360/

(4) Understand The Importance Of Market Liquidity In Forex Trading

(6) https://www.reuters.com/markets/global-markets-wrapup-1-2025-01-13/

(7) POEMS CFD MT5 platform

More Articles

Playing Defence: Diversification in Forex Trading

Learn how strategic planning and risk management can help you navigate the highs and lows of the forex market. Don’t miss out on unlocking the secrets to long-term profitability!

From Boom to Bust: Lessons from the Barings Bank Collapse

Did you know that the collapse of Barings Bank in 1995 was from massive losses incurred by a rogue trader? Delve into the tale of how Nick Leeson’s fraudulent investments sent shockwaves through the financial world.

Japan's Economic Resurgence – Unveiling the Tailwinds Behind Nikkei 225’s Record Leap

Discover the driving forces behind Japan’s market surge, delve into its economic performance and learn how CFD products can help you navigate the Japanese market’s volatility via our article!

Disclaimer

These commentaries are intended for general circulation and do not have regard to the specific investment objectives, financial situation and particular needs of any person. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. You should seek advice from a financial adviser regarding the suitability of any investment product(s) mentioned herein, taking into account your specific investment objectives, financial situation or particular needs, before making a commitment to invest in such products.

Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of units in any fund and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance.

Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

CFD Promotion Disclaimer

This promotion is provided to you for general information only and does not constitute a recommendation, an offer or solicitation to buy or sell the investment product mentioned. It does not have any regard to your specific investment objectives, financial situation or any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of your acting based on this information.

Investments are subject to investment risks. The risk of loss in leveraged trading can be substantial. You may sustain losses in excess of your initial funds and may be called upon to deposit additional margin funds at short notice. If the required funds are not provided within the prescribed time, your positions may be liquidated. The resulting deficits in your account are subject to penalty charges. The value of investments denominated in foreign currencies may diminish or increase due to changes in the rates of exchange. You should also be aware of the commissions and finance costs involved in trading leveraged products. This product may not be suitable for clients whose investment objective is preservation of capital and/or whose risk tolerance is low. Clients are advised to understand the nature and risks involved in margin trading.

You may wish to obtain advice from a qualified financial adviser, pursuant to a separate engagement, before making a commitment to purchase any of the investment products mentioned herein. In the event that you choose not to obtain advice from a qualified financial adviser, you should assess and consider whether the investment product is suitable for you before proceeding to invest and we do not offer any advice in this regard unless mandated to do so by way of a separate engagement. You are advised to read the trading account Terms & Conditions and Risk Disclosure Statement (available online at https://www.poems.com.sg/) before trading in this product.